Litecoin Price Prediction: Technical Oversold Conditions Meet Growing Institutional Adoption

#LTC

- Oversold technical conditions near Bollinger Band support suggest potential rebound

- Mixed regulatory news with ETF delays offset by record institutional adoption

- MACD momentum improvement indicates weakening selling pressure

LTC Price Prediction

Technical Analysis: LTC Shows Oversold Conditions with Potential Reversal Signals

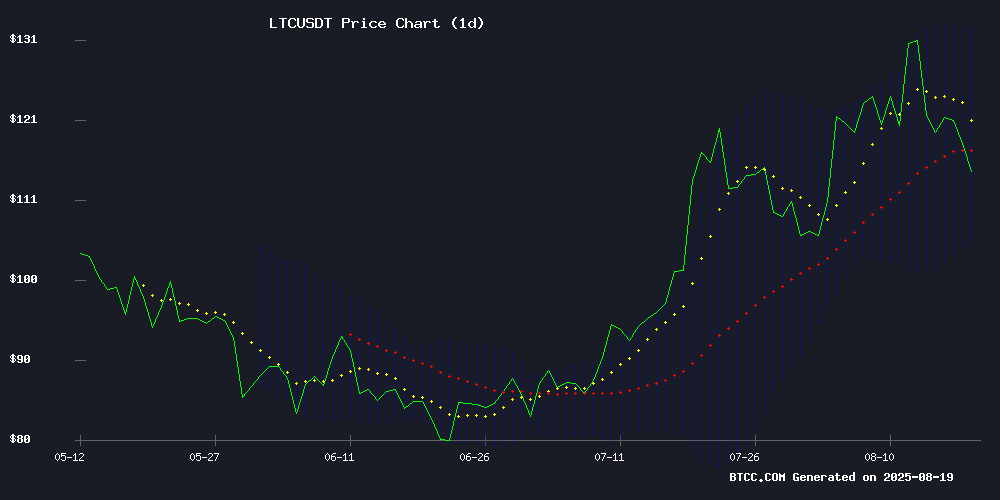

Litecoin is currently trading at $115.81, sitting below its 20-day moving average of $118.88, indicating short-term bearish pressure. The MACD reading of -4.55 versus -5.73 signal line shows improving momentum despite remaining in negative territory. 'The MACD histogram turning positive at 1.18 suggests weakening downward momentum,' notes BTCC financial analyst Sophia. 'LTC is trading NEAR the lower Bollinger Band at $105.26, which often acts as a support level during oversold conditions.'

Market Sentiment: Mixed Signals Amid Regulatory Delays and Institutional Growth

Recent news presents a complex landscape for Litecoin. While SEC delays on XRP ETF decisions create regulatory uncertainty, institutional crypto flows hitting record $244 billion AUM demonstrate growing mainstream adoption. 'Litecoin's inclusion in top altcoins for August gains highlights its resilience,' says BTCC financial analyst Sophia. 'The cloud mining developments, while mixed with some negative sentencing news, show continued infrastructure growth supporting the broader ecosystem.'

Factors Influencing LTC's Price

SEC Delays XRP ETF Decisions, Deadlines Pushed to October 2025

The U.S. Securities and Exchange Commission has postponed its decisions on several cryptocurrency exchange-traded funds, including spot XRP ETFs, until October 2025. The delay affects proposals from major firms such as Grayscale, 21Shares, Bitwise, and CoinShares.

Grayscale's spot Dogecoin ETF and CoinShares' planned Litecoin ETF are among the impacted filings. The SEC's move underscores the regulatory hurdles facing crypto-based financial products despite growing institutional interest.

Crypto Influencer Sentenced to 12 Months for $3.5M Cloud Mining Scheme

A self-proclaimed cryptocurrency influencer, Charles O. Parks III, known online as "CP3O," has been sentenced to one year and one day in prison for orchestrating a $3.5 million cryptojacking scheme. The U.S. Department of Justice revealed that Parks used fabricated business identities to fraudulently obtain elevated cloud computing access, which he then exploited to mine ethereum (ETH), Litecoin (LTC), and Monero (MON).

Between January and August 2021, Parks siphoned cloud resources to generate nearly $1 million in digital assets. Prosecutors detailed how he laundered proceeds through cryptocurrency exchanges, an NFT marketplace, and traditional financial channels, splurging on luxury items including a Mercedes-Benz and first-class travel. The court ordered forfeiture of $500,000 and the vehicle, with restitution amounts pending.

Ethereum Dominates Institutional Crypto Flows as Digital Assets Hit Record $244 Billion AUM

Institutional investors are pouring unprecedented capital into digital assets, with Ethereum emerging as the clear beneficiary. CoinShares data reveals $3.75 billion flowed into crypto investment products last week—the fourth-largest weekly influx on record—pushing total assets under management to an all-time high of $244 billion.

Ethereum commanded 77% of the inflows at $2.87 billion, a staggering concentration that underscores its growing status as a Core institutional holding rather than a speculative bet. Year-to-date ETH inflows now stand at $11 billion, dwarfing Bitcoin's proportional adoption. The network's maturation—from staking infrastructure to custody solutions—has created a compelling yield-generating framework for professional managers.

While altcoins saw respectable interest—$176.5 million for Solana and $125.9 million for XRP—the week belonged decisively to Ethereum. Litecoin and Toncoin experienced negligible outflows, mere footnotes to ETH's dominant narrative. Market reactions remained measured, suggesting these flows represent strategic positioning rather than speculative frenzy.

Find Mining Launches XRP Cloud Mining Contracts Amid Market Volatility

XRP's price turbulence this month—plunging from $3.34 to $3.10 amid $1 billion liquidations before stabilizing post-Ripple lawsuit—has left investors wary. Analysts see a path to $3.90 if resistance breaks, but macroeconomic uncertainty lingers.

Find Mining now offers cloud-based XRP mining contracts, targeting holders seeking stability. The platform requires no hardware or active management, settling profits daily. "Idle XRP can now generate income without exposure to market swings," the announcement implied.

The service supports direct XRP deposits alongside BTC, DOGE, and major stablecoins. Security features include wallet isolation and encrypted settlements, while a $15 sign-up bonus lowers entry barriers.

Top Altcoins for August Gains: Chainlink, VeChain, Pi Coin, Remittix, and Litecoin in Focus

August's altcoin market is zeroing in on five standout projects, each offering distinct value propositions. chainlink (LINK) surged 17% in a single day, fueled by whale accumulation and institutional interest, with analysts eyeing $25-$27 as near-term targets. VeChain (VET) holds steady at $0.025, supported by its enterprise supply chain solutions, while Pi Coin and Remittix gain traction through community momentum and infrastructure milestones respectively.

Litecoin (LTC) rounds out the group as the legacy contender, benefiting from its established network effects. Market participants appear to be balancing technical plays with fundamental bets, creating a bifurcated landscape where both breakout tokens and utility-driven projects find demand.

ALL4 Mining Launches Bitcoin Cloud Mining Strategy for Passive Income

Bitcoin's resurgence as 'digital gold' has reignited investor interest, but traditional 'hold and wait' strategies are losing appeal. ALL4 Mining addresses this shift with its new BTC cloud mining contracts, offering a streamlined path to daily passive income without hardware or technical barriers.

The platform eliminates upfront costs and maintenance burdens, allowing users to convert BTC holdings into recurring revenue through an algorithmic approach. Daily payouts, a $15 registration bonus, and multi-cryptocurrency support—including DOGE, ETH, and USDT—position the service as a flexible option in a volatile market.

Notably absent are management fees, while a referral program promises up to $37,777 in bonuses, suggesting aggressive user acquisition tactics. This comes as regulatory clarity around cryptocurrencies grows, potentially accelerating mainstream adoption of such yield-generating models.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, Litecoin shows potential for a near-term rebound toward the $125-130 range. The oversold conditions near Bollinger Band support, combined with positive MACD momentum divergence, suggest a technical recovery is likely. However, regulatory uncertainties from delayed ETF decisions may cap significant upside beyond the $132.50 resistance level in the short term.

| Price Level | Significance | Probability |

|---|---|---|

| $105-110 | Strong Support Zone | High |

| $125-130 | Near-term Target | Medium-High |

| $132+ | Key Resistance | Medium |